Artists Taking Action

Created for Best of Artists and Artisans web site

By Bridgette Mongeon © 2008

Recently I received an e-mail in my inbox that caused me to clean my clay filled hands and take action. It was from sculptor Boaz Vaadia in Brooklyn, NY, expressing urgency in supporting the Artist deduction bill S. 548 and HR 1524. The e-mail included links to Americans for the Arts. This is a wonderful organization that is working for each of us. According to their website:

Americans for the Arts is the nation’s leading nonprofit organization for advancing the arts in America. With 45 years of service, we are dedicated to representing and serving local communities and creating opportunities for every American to participate in and appreciate all forms of the arts.

This bill S. 548 and HR 1524 is described on the Americans for the Arts policy and advocacy page, but let me sum it up in this article.

Since 1969 those working in the arts have not been allowed to deduct the fair market value of their artwork when donating it. The bill “would allow creators of original works to deduct the fair-market value of self-created works given to and retained by a nonprofit institution.” Currently, those working in the arts can only deduct what it cost to create it. Here is some more information from the Americans for the Arts website that indicates the importance of this bill and how immediate the effect of the 1969 legislation was.

- The Museum of Modern Art in New York received 321 gifts from artists in the three years prior to 1969; in the three years after 1969 the museum received 28 works of art from artists—a decrease of more than 90 percent.

- The biggest loser was the Library of Congress, which annually received 15 to 20 large gifts of manuscripts from authors. In the four years after 1969, it received one gift.

- Dr. James Billington, Librarian of Congress, says, “The restoration of this tax deduction would vastly benefit our manuscript and music holdings, and remove the single major impediment to developing the Library’s graphic art holdings. [The] bill would also benefit local public and research libraries. When this tax deduction was allowed in the past, many urban and rural libraries profited from the donation of manuscripts and other memorabilia from authors and composers who wanted their creative output to be available for research in their local communities.”

H.R. 1524 and S. 548 are identical to legislation that the Senate has passed five times in the past few years, but that has not been reviewed by the House.

This bill affects every creative person, not just sculptors. Please take note.

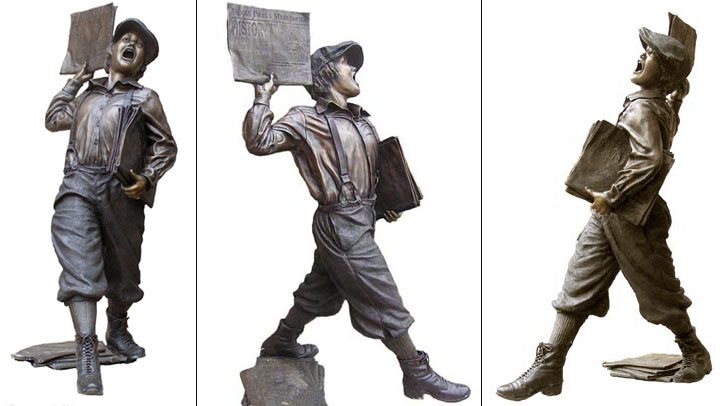

Since I learn best by example, here is one for you to ponder. I have created a life-size newsboy sculpture. There are 10 in the edition of the life size sculpture and they sell for $23,000. I have sold two in the edition. One for the Texas Press Association, who commissioned me to create the piece, the second for the Tabor City Tribune. It costs me approximately $6,000 to pour the newsboy in bronze. I have worked hard to develop a reputation as an artist and to sell the remaining in the edition spending hours on press releases about “Carving newspaper headlines in history,” documenting the process on my website and in an online video number one , and number two. I spent many hours and a great deal of money in mailings and marketing. It would make my heart skip a beat if I could somehow get one of these newsboys into the Albright Knox Art Gallery in my home town of Buffalo, New York. If somehow I could find the funds to pour the sculpture and donate it, and if they accepted the piece, I could only deduct the $6,000- the cost of pouring this sculpture as my tax deduction and not the entire $23,000 That is a loss of $17,000 of income for my sculpture and my pocket book. However, if someone else bought the sculpture and donated it, they could deduct the entire $23,000.

Another example is a piece I am currently working on of Richard Hathaway of Vermont College Union Institute and Goddard College. I am donating my labor and part of the casting costs, a total of approximately $25,000. The City of Montpelier has donated the cost of casting the sculpture. It will be installed this year at the TW Wood Gallery in Montpelier, Vermont. My taxable deduction for a year and a half worth of work $0.00.

I contacted the executive director of the St. Louis Volunteer Lawyer and Accountants for the Arts. “Unfortunately, I often deliver bad news to artists: they can only claim the cost of their materials when they donate a work of art to a nonprofit organization, while a collector can claim the fair market value. The proposed legislation, which includes some caveats, would allow some artists to receive an equitable tax deduction. It’s been on the table before, but it looks like it has some momentum this year, so artists should take a moment to contact their legislators,” states Sue Greenberg.

The Americans for the Arts website makes it quite easy to get involved. By going to the artist’s action center you can fill in your zip code and see if your senator supports the bill. There is a simple form for you to e-mail to your representative or print out a letter with your request for support.

I know it is difficult to take time away from our creativity to become politically involved. It is however, very important to our livelihood. Thank you for your support and your actions.

Here is an update on some of my Creative Endeavors!

Recent articles written by Ms. Mongeon

“Exploring Digital Technologies as Applied to Traditional Sculpting.” Sculpture Review. (Winter 2007) 30.

“The American.” Sculpture Review. (Winter 2007) 32.“Artful Business-The Basics of Designing your Website.” Sculptural Pursuit. Vol. 7 No. 1. (Spring 2008) 50. March 2004

All written work is copyrighted and cannot be used, whole or in part,

without the written consent of the author.